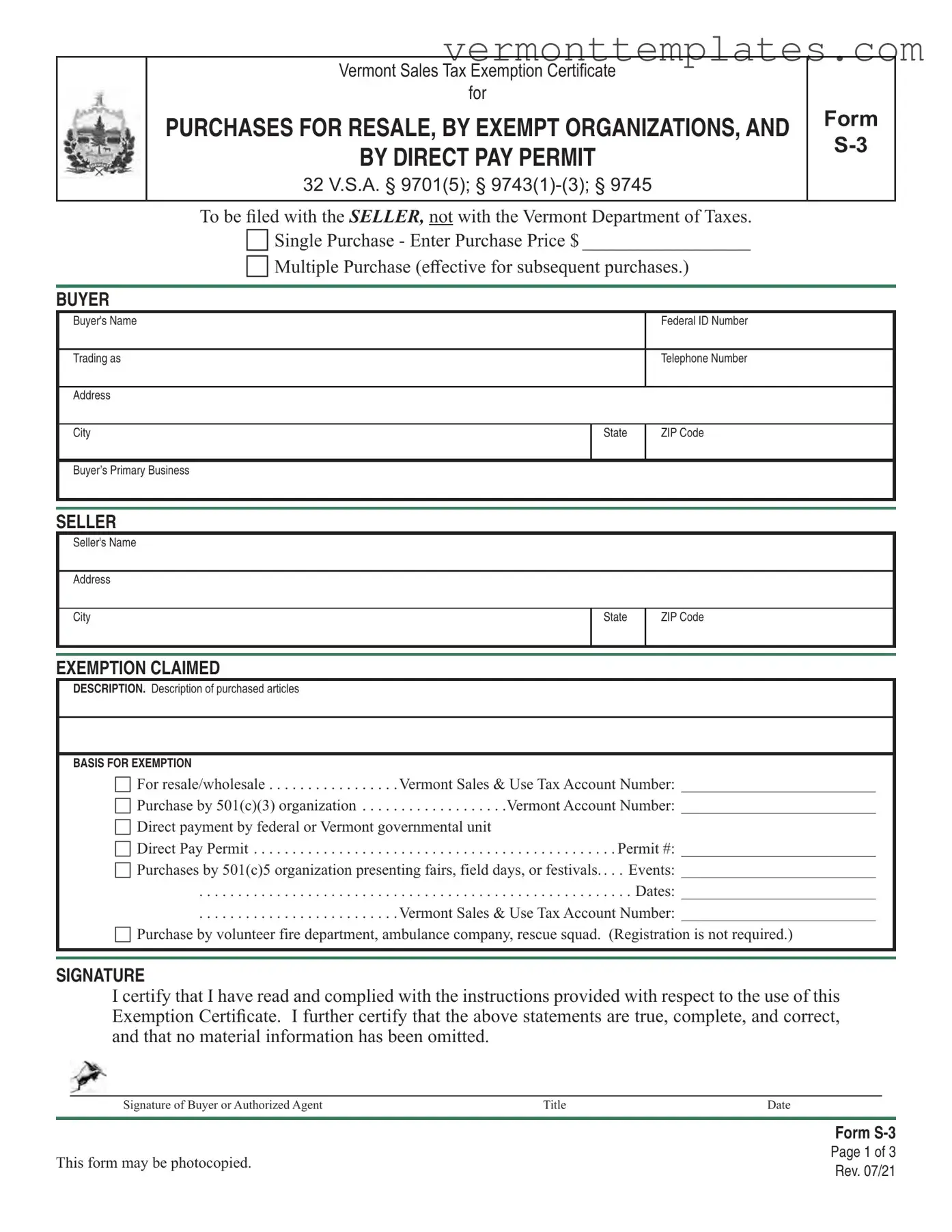

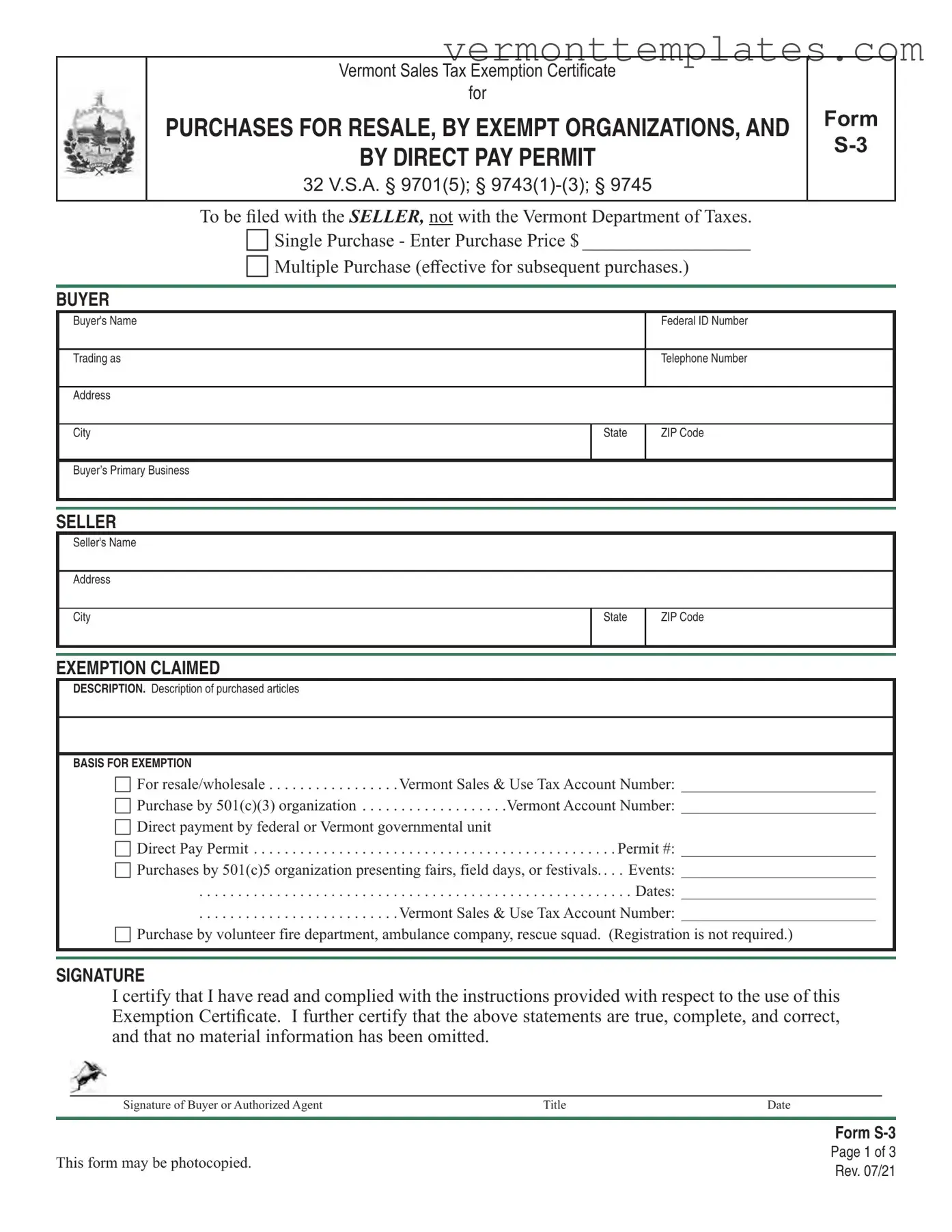

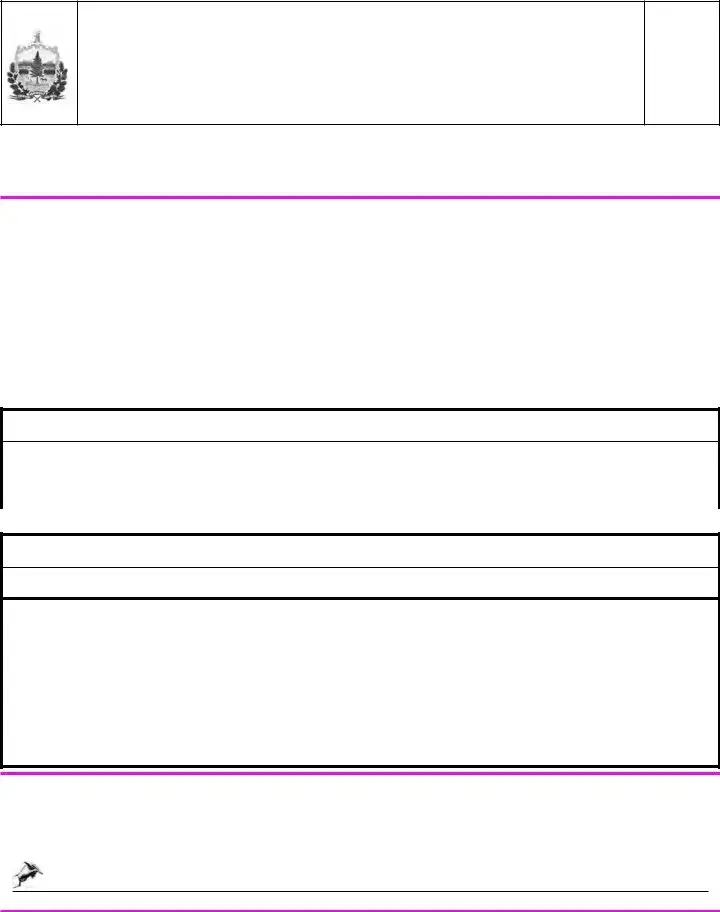

FORM S-3 Instructions

Vermont Sales Tax Exemption Certificate for

Purchases for Resale, by Exempt Organizations, and by Direct Pay Permit

This exemption certificate does not apply to contractors.

General Information

Please print in BLUE or BLACK ink only.

This exemption certificate applies to the following:

•Purchase(s) of tangible personal property for the purpose of resale

•Purchase(s) by an organization which is designated as a 501(c)(3) by the Internal Revenue Service, or agricultural organizations qualified for exempt status under § 501(c)(5) when presenting agricultural fairs, field days, or festivals

•Purchase(s) by a Federal or Vermont governmental unit (direct payment)

•Purchase(s) using a Direct Pay Permit

•Purchase(s) by a volunteer fire department, ambulance company, or rescue squad

Please note: Civic, social, recreational, and business league organizations are not 501(c)(3) organizations, and therefore cannot make exempt purchases.

Accepting an Exemption Certificate in “Good Faith”

The buyer must present to the seller an accurate and properly executed exemption certificate for the exempted sale. The responsibility is on the seller to determine if the buyer is submitting the exemption certificate in “good faith.” This requires the seller to be familiar with Vermont Sales and Use Tax law and regulations, including exemptions, that apply to the seller’s business. If the buyer provides a certificate that is not valid, i.e., the item purchased does not qualify for the exemption, this is not in good faith and the seller should not accept the certificate. When the seller accepts the certificate in good faith, the seller is not liable for collecting and remitting Vermont Sales Tax.

An exemption certificate is received at the time of sale in good faith when all of the following conditions are met:

•The certificate contains no statement or entry which the seller knows, or has reason to know, is false or misleading.

•The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language.

•The certificate is signed, dated and complete (all applicable sections and fields completed).

•The property purchased is of a type ordinarily used for the stated purpose, or the exempt use is explained.

Form S-3