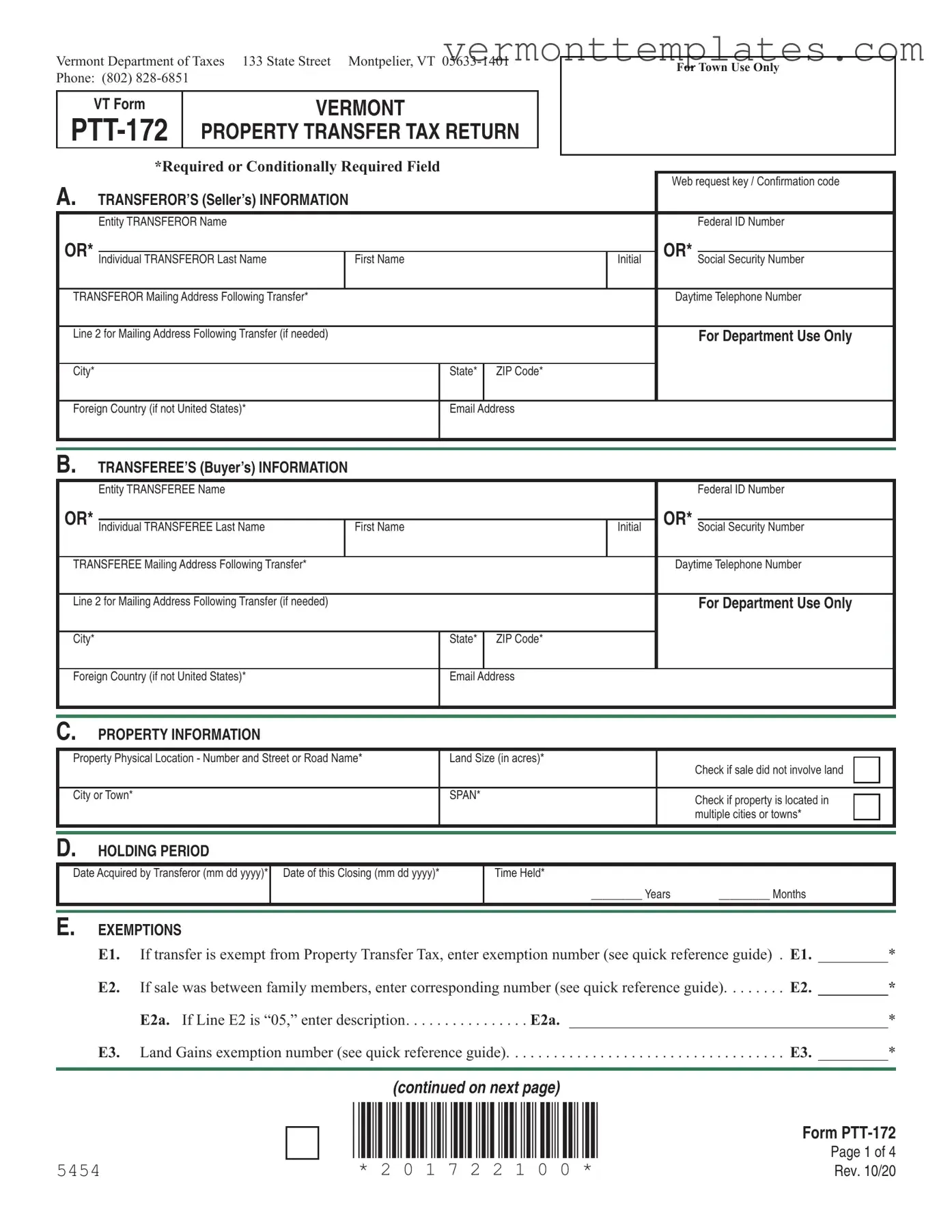

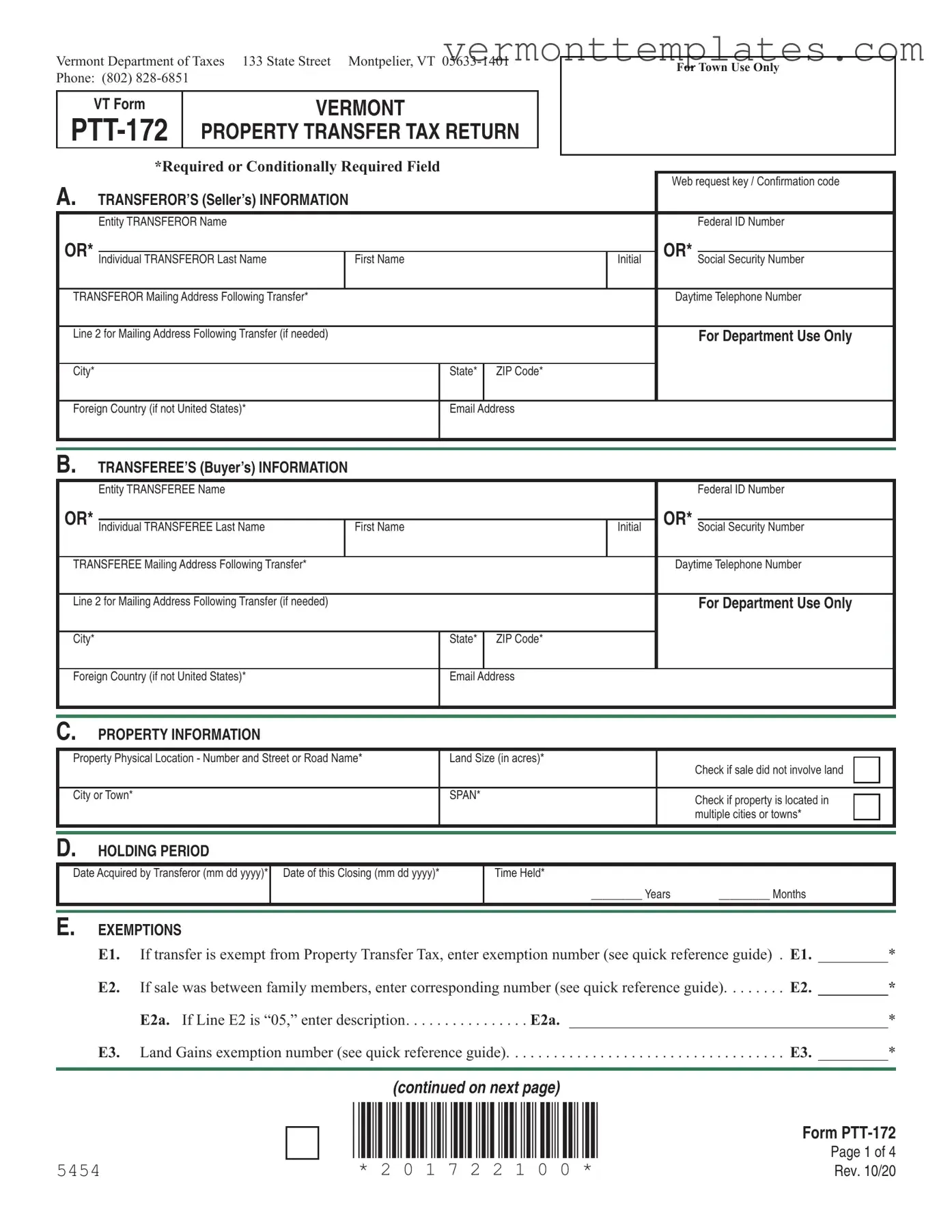

F. |

TRANSFER INFORMATION |

|

|

|

|

|

|

F1. |

How did the Transferor acquire this property? (see quick reference guide) . . . . |

. . . . . . . . . . . . |

. . . . . . . . F1. _________* |

|

|

F1a. |

If Line F1 is “04,” enter description |

F1a. _________________________________________* |

|

F2. |

Interest conveyed in this transfer (see quick reference guide) . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . |

. . . . . . . . F2. _________* |

|

|

F2a. |

If Line F2 is “07,” enter percent of interest here |

. . . . . . . . . . . . . |

. F2a. ________________ . _______% * |

|

|

F2b. |

If Line F2 is “08,” enter description |

F2b. _________________________________________* |

|

F3. |

Type of building construction at time of transfer (see quick reference guide) . . |

. . F3. ________ ________ |

_______* |

|

|

F3a. |

If Line F3 is “05,” enter number of units transferred . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . |

. . . . . . . F3a. _________* |

|

|

F3b. |

If Line F3 is “06,” enter number of dwelling units transferred |

. . . . . . . . . . . . |

. . . . . . . F3b. _________* |

|

|

F3c. |

If Line F3 is “20,” enter description |

F3c. _________________________________________* |

|

F4. |

Was the transferee a tenant prior to this transfer? |

. . . . . . . . . . . . . . . |

. . . . . F4. |

cYes* |

cNo* |

|

F5. |

Financing |

F5. cConventional/Bank* |

cOwner Financing* |

cOther* |

|

|

F5c. |

If Line F5 is “Other,” enter description |

F5c. _________________________________________* |

|

F6. |

Do you intend to record this return with the Town/City within 60 days of the closing? . . F6. |

cYes* |

cNo* |

|

|

|

|

G. |

AGRICULTURAL / MANAGED FOREST LAND USE VALUE PROGRAM, 32 V.S.A. CHAPTER 124 |

|

|

|

G1. |

Is all or part of the property being transferred enrolled in the Current Use |

|

cYes* |

cNo* |

|

|

(Use Value Appraisal) Program? |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . |

G1. |

|

G2. |

To continue enrollment in the Current Use Program, the new owner must submit a |

|

|

|

|

Current Use Application within 30 days of the recording date. Will the new owner |

cYes* |

cNo* |

|

|

be submitting that application? |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

. . . . . . . .G2. |

|

|

|

|

|

|

|

H. |

TRANSFER INFORMATION |

|

|

|

|

|

|

H1. |

Transferor’s use of property BEFORE transfer (see quick reference guide) . . . |

. . . . . . . . . . . . |

. . . . . . . . H1. _________* |

|

|

H1a. If Line H1 is “07,” “08,” or “09,” enter description. . . . |

H1a.__________________________________________* |

|

H2. |

Transferee’s use of property AFTER transfer (see quick reference guide) . . . . |

. . . . . . . . . . . . |

. . . . . . . . H2. _________* |

|

|

H2a. If Line H2 is “07,” “08,” or “09,” enter description. . . . |

H2a.__________________________________________* |

|

H3. |

Was the property rented BEFORE transfer? |

. . . . . . . . . . . . . |

. . . . . . . .H3. |

cYes* |

cNo* |

|

H4. |

Will the property be rented AFTER transfer? |

. . . . . . . . . . . . . |

. . . . . . . .H4. |

cYes* |

cNo* |

|

H5. |

Have development rights been conveyed separately? |

. . . . . . . . . . . . . . . . . |

H5. |

cYes* |

cNo* |

|

H6. |

Does the transferee hold title to any adjoining property? |

. . . . . . . . . . . . . . |

. . . . . . . H6. |

cYes* |

cNo* |

|

H7. |

Is the transferee a grantor’s revocable trust? |

. . . . . . . . . . . . . |

H7. |

cYes* |

cNo* |

|

|

|

|

|

|

|

|

|