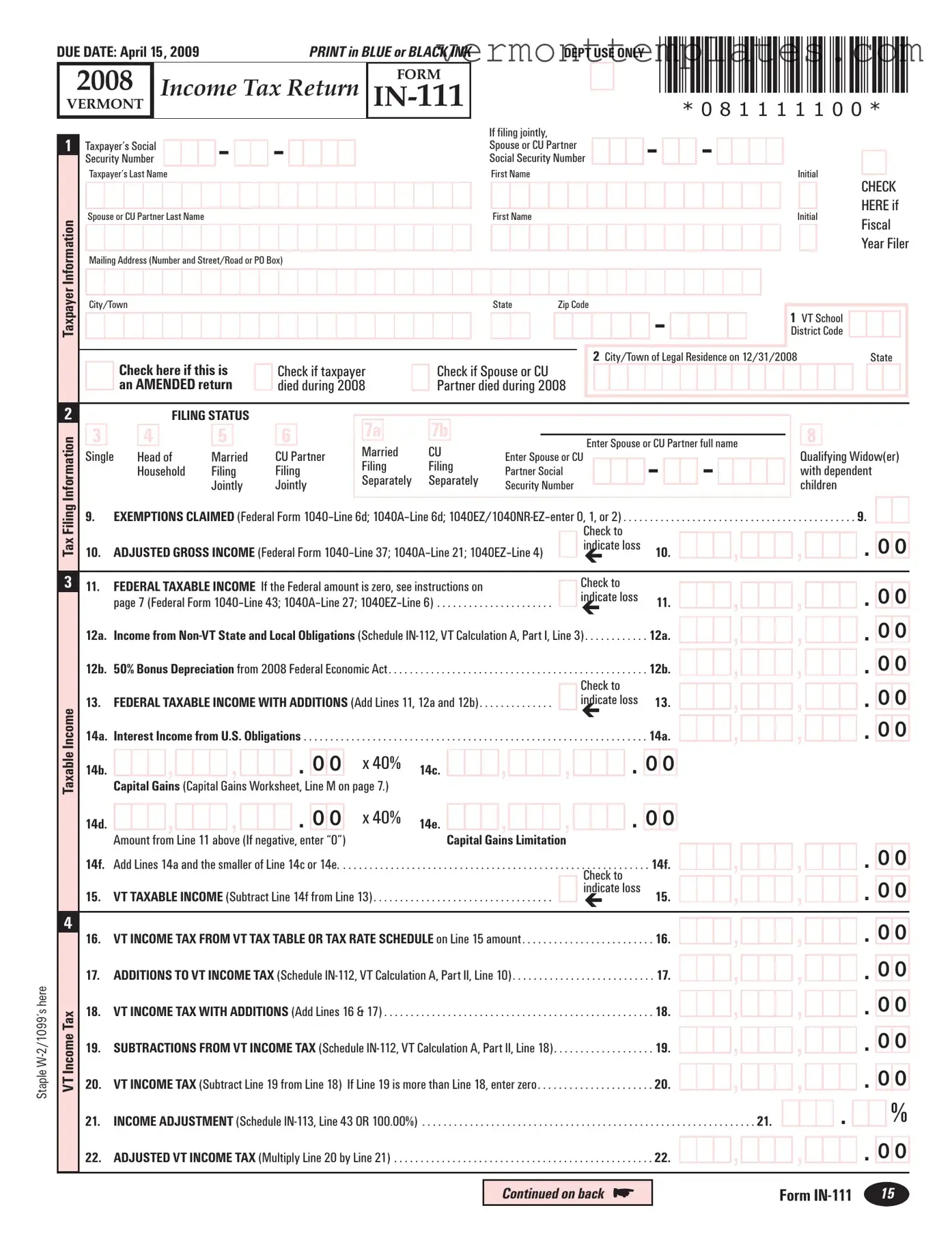

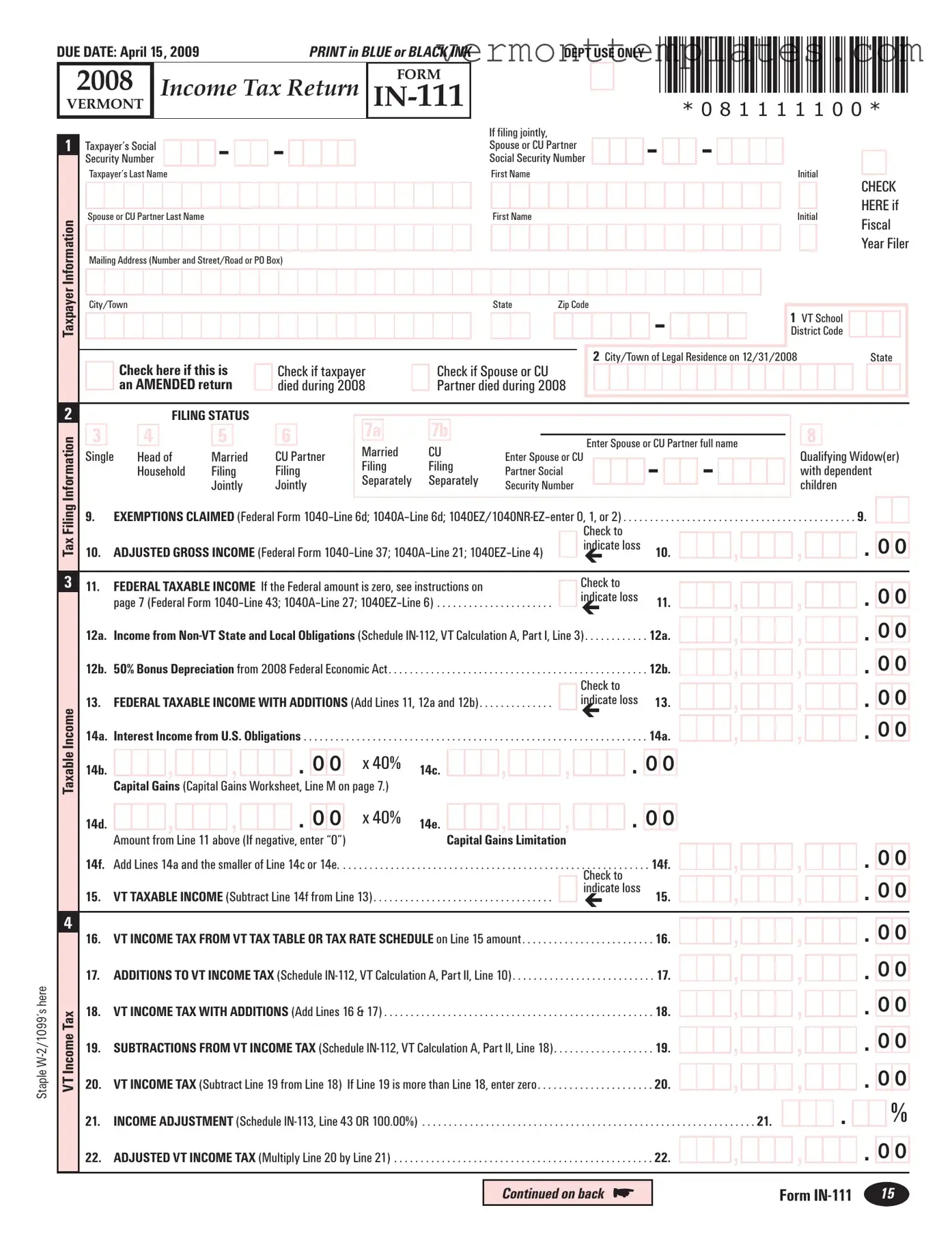

The Vermont IN-111 form is similar to the Federal Form 1040, which is the standard individual income tax return used in the United States. Both forms require taxpayers to report their income, claim deductions, and calculate their tax liability. They share a similar structure, including sections for personal information, filing status, exemptions, and income calculations. Taxpayers must provide accurate information to ensure compliance with tax laws and avoid penalties.

Another comparable document is the Federal Form 1040A. This form serves as a simplified version of the 1040 and is used by individuals with straightforward tax situations. Like the IN-111, it allows for the reporting of income and deductions but limits the types of income that can be reported. Both forms guide taxpayers through the process of calculating their taxable income and tax liability, making them accessible for those who may not have extensive tax knowledge.

The Florida Lottery DOL-129 form plays a crucial role for businesses aiming to participate in the lottery system in Florida, as they must navigate regulations similar to those in other states for their respective tax forms. For more information on the essential documentation needed, you can refer to All Florida Forms, which outlines the requirements and processes associated with becoming a licensed lottery retailer.

The Federal Form 1040EZ is also similar to the Vermont IN-111. This form is the simplest federal income tax return available, designed for single or married filers without dependents. Both forms require basic personal information and allow taxpayers to report income and calculate taxes owed. The 1040EZ, however, does not permit itemized deductions, which aligns with the straightforward nature of the IN-111, focusing on essential income and tax calculations.

The New York State IT-201 form is another document that resembles the Vermont IN-111. This form is used by residents of New York to file their state income tax returns. Both forms require similar information, including income details, deductions, and credits. They also share the purpose of determining state tax liability based on reported income, making them essential for state compliance.

The Massachusetts Form 1 is similar in function to the Vermont IN-111. This form is the Massachusetts resident income tax return, requiring taxpayers to report their income and calculate their tax owed. Both forms contain sections for personal information, exemptions, and deductions, and they guide users through the process of filing state taxes accurately.

The California Form 540 is another comparable document. This form is used by California residents to report their income and calculate state taxes. Like the IN-111, it requires detailed income information and allows for deductions. Both forms serve the same fundamental purpose of ensuring taxpayers fulfill their state tax obligations based on their financial circumstances.

The Illinois Form IL-1040 is also similar to the Vermont IN-111. This form is the individual income tax return for Illinois residents. Both documents require taxpayers to provide personal information, report income, and calculate tax liability. They serve as essential tools for residents to comply with state tax laws and accurately report their financial situations.

Lastly, the Pennsylvania PA-40 form bears similarities to the Vermont IN-111. This form is used by Pennsylvania residents to file their state income tax returns. Both forms require comprehensive income reporting, deductions, and credits, guiding taxpayers through the necessary calculations to determine their tax liability. They ensure that residents meet their state tax obligations while providing a structured format for reporting financial information.