|

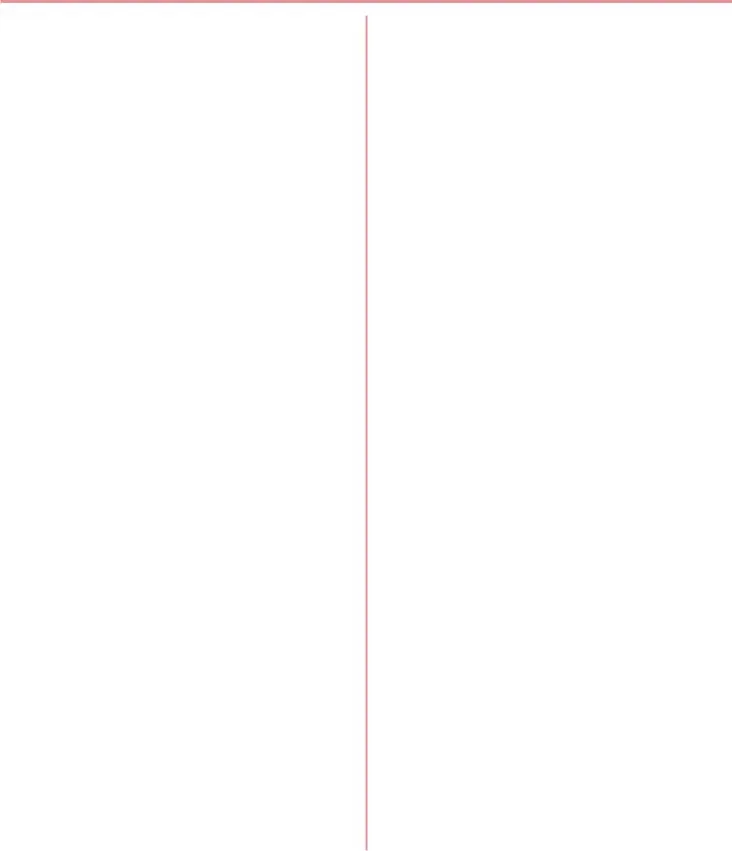

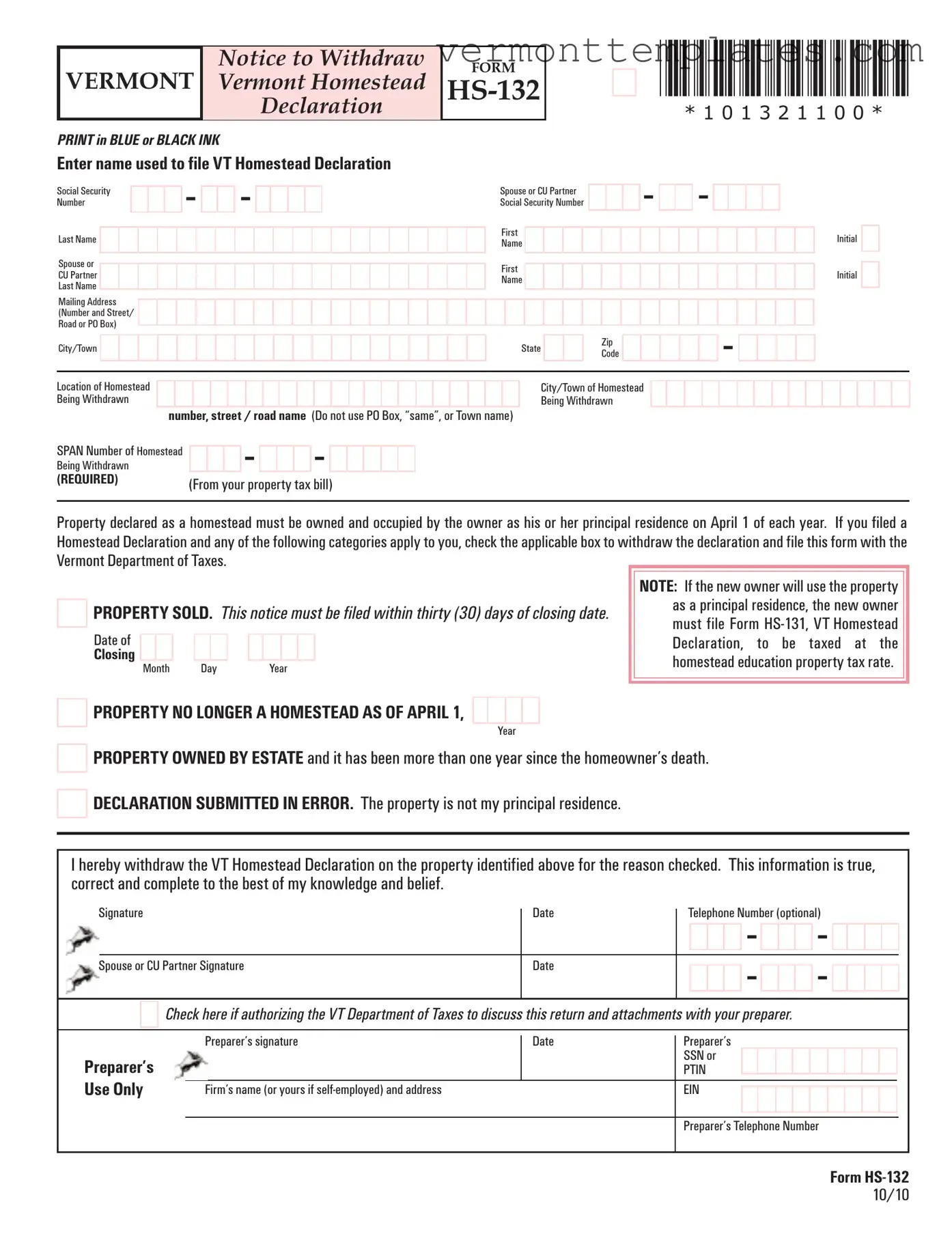

NOTICE TO WITHDRAW |

FORM |

VERMONT |

VERMONT HOMESTEAD |

HS-132 |

|

DECLARATION |

|

|

|

|

|

|

|

*101321100*

*101321100*

*101321100*

PRINT IN BLUE OR BLACK INK

Enter name used to file VT Homestead Declaration

Social Security |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CU Partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse or CU Partner Social Security Number

First

Name

First

Name

Mailing Address (Number and Street/ Road or PO Box)

City/Town

Location of Homestead Being Withdrawn

City/Town of Homestead

Being Withdrawn

number, street / road name (Do not use PO Box, “same”, or Town name)

SPAN Number of Homestead |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Being Withdrawn |

|

|

|

|

|

|

|

|

|

|

|

|

(REQUIRED) |

(From your property tax bill) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property declared as a homestead must be owned and occupied by the owner as his or her principal residence on April 1 of each year. If you filed a Homestead Declaration and any of the following categories apply to you, check the applicable box to withdraw the declaration and file this form with the Vermont Department of Taxes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: If the new owner will use the property |

|

PROPERTY SOLD. |

This notice must be filed within thirty (30) days of closing date. |

as a principal residence, the new owner |

|

must file Form HS-131, VT Homestead |

|

Date of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration, to be taxed at the |

|

Closing |

|

|

|

|

|

|

|

|

|

|

|

|

homestead education property tax rate. |

|

|

Month |

|

Day |

|

|

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPERTY NO LONGER A HOMESTEAD AS OF APRIL 1,

Year

PROPERTY OWNED BY ESTATE and it has been more than one year since the homeowner’s death.

DECLARATION SUBMITTED IN ERROR. The property is not my principal residence.

I hereby withdraw the VT Homestead Declaration on the property identified above for the reason checked. This information is true, correct and complete to the best of my knowledge and belief.

Signature |

Date |

Telephone Number (optional) |

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse or CU Partner Signature |

Date |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if authorizing the VT Department of Taxes to discuss this return and attachments with your preparer.

Preparer’s signature |

Date |

Preparer’s |

|

|

SSN or |

|

|

|

|

|

|

|

|

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours if self-employed) and address |

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS FOR FORM HS-132

NOTICE TO WITHDRAW VERMONT HOMESTEAD DECLARATION

Use this form to withdraw a Homestead Declaration if:

(1)you have sold the property;

(2)it is no longer being used as a homestead;

(3)the property is owned by an estate and it has been more than one year since the homeowner's death; or

(4)the declaration was submitted in error.

HOMEOWNER INFORMATION

Enter the name and Social Security Number of the homeowner who filed the Homestead Declaration.

Enter the address where correspondence concerning the Homestead Declaration for this property should be sent.

Enter the physical location and the city/town where the property is located. The physical location is the number of the street or road and city/town of the property. Example: 123 Main Street Montpelier 658 Route 12 Elmore 79 Swift Street Condo B-7 Burlington

SPAN (School Property Account Number): This is a unique identification number assigned by the town. Enter the 11-digit number printed in the Housesite information section of the property tax bill.

REASON FOR WITHDRAWING DECLARATION

Check the box for the applicable situation to withdraw the Homestead Declaration.

(1)Property Sold Notification to the VT Department of Taxes that a property has been sold is required within thirty (30) days of the closing date. If the sale is after April 1, the property continues to be classified as a homestead until the following April 1. If the new owner uses the property as his or her principal homestead, he or she must file a Homestead Declaration in order to make a property tax adjustment claim. Sale of property includes conveyance of the property to a trust or creation of a life estate. A person who transferred his or her homestead to a revocable trust and who is the sole beneficiary files a Homestead Declaration by the following April 15 and checks Box 4a. If the life estate owner occupies the property as a homestead, the life estate holder must record

the life estate deed in the town offices and file a Homestead Declaration by the following April 15 checking Box 4b.

See 32 V.S.A. §§5401(7)(D) and 6062(e) for more information on homesteads owned by a trust or estate.

(2)Property No Longer A Homestead When the property is no longer used as a homestead, the Homestead Declaration must be withdrawn. Example: You filed a homestead declaration April 15 but move on September 1 of the same year and now rent the house.

(3)Property Owned By Estate Estates may be classified as homestead property up to the April 1 following the date of the homeowner's death provided the property is not rented during that time. The Homestead Declaration must be withdrawn after that year. Example: Property was the principal residence of a homeowner who died in 2011. The estate now owns the property. The property may remain classified as a homestead and be taxed at the homestead education property tax rate until April 2012 provided the property is not rented.

(4)Declaration submitted in error If you submitted a Homestead Declaration for a property that is not your principal residence, use this form to withdraw the declaration.

Signature The person who filed the Homestead Declaration signs this form. If you are signing on behalf of the homeowner, such as an estate, please use the preparer's signature area to provide your information so we may contact you should there be any questions.

*101321100*

*101321100*

-

-