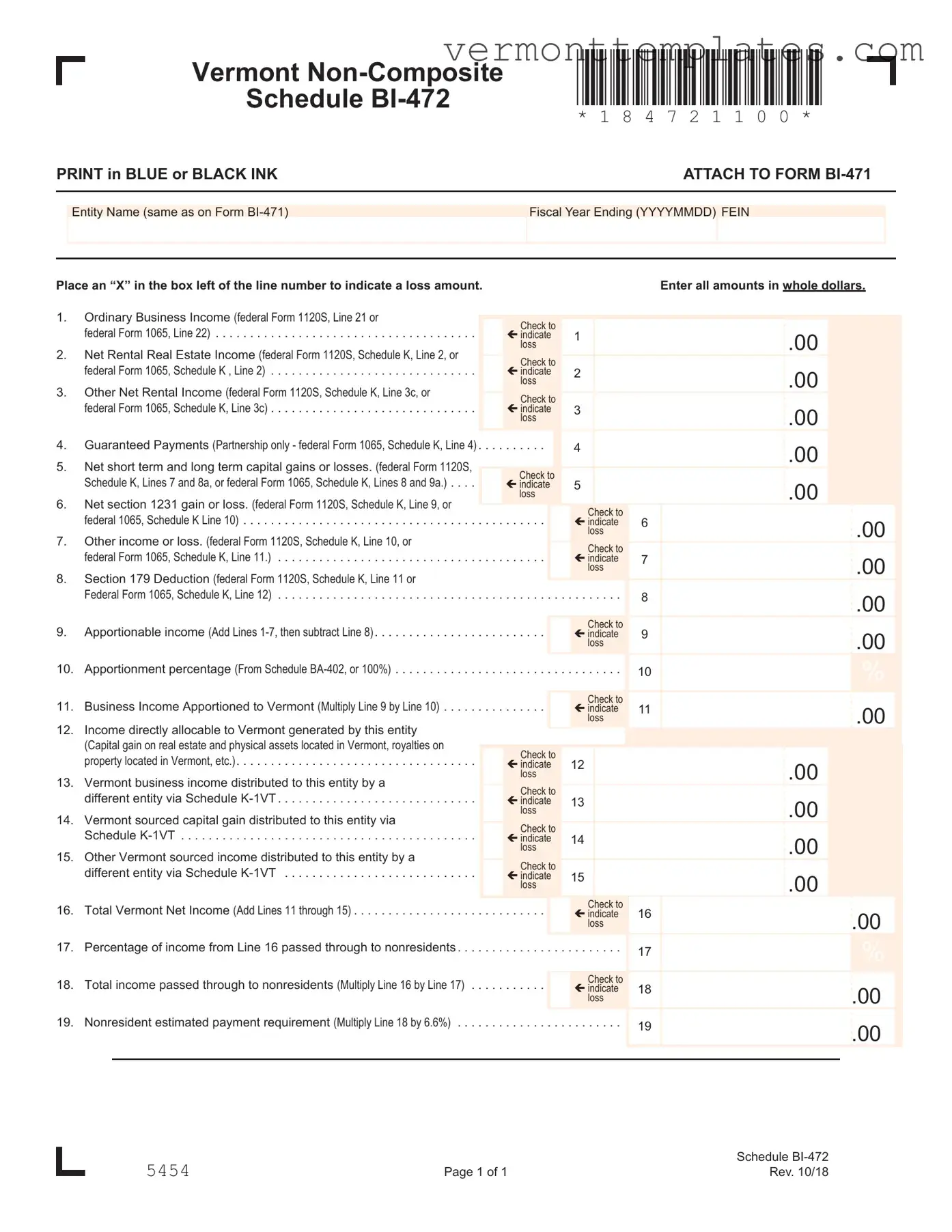

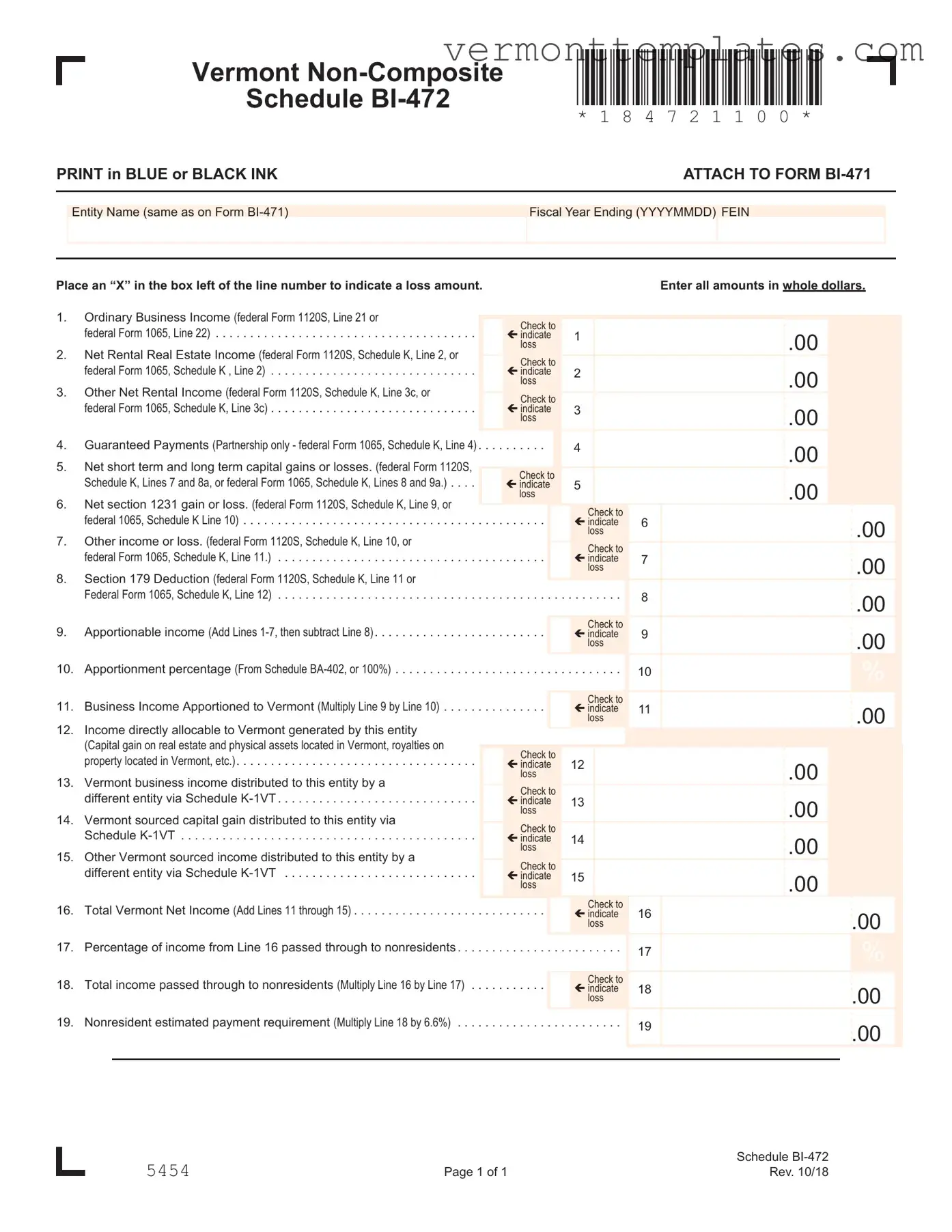

The Vermont BI-472 form is similar to the federal Form 1120S, which is used by S corporations to report income, deductions, and credits. Both forms require businesses to provide a detailed account of their ordinary business income and other income sources. The structure of these forms is similar, as they both break down income into specific categories, such as rental income and capital gains. This allows for a clear comparison of financial performance and ensures that the income reported aligns with federal requirements.

Another document that resembles the Vermont BI-472 is the federal Form 1065. This form is designed for partnerships and also captures various types of income and deductions. Like the BI-472, it includes sections for reporting guaranteed payments and net rental income. Both forms help ensure that the income is accurately apportioned to the appropriate state, making it easier for entities to comply with state tax laws while also aligning with federal regulations.

The Schedule K-1 is also akin to the Vermont BI-472 form. This document provides detailed information about each partner's share of income, deductions, and credits from a partnership. Similar to the BI-472, the K-1 breaks down income sources, allowing for clarity in reporting. Both documents serve the purpose of distributing income to individual partners or shareholders, ensuring that everyone involved understands their tax obligations based on the entity's overall performance.

The Vermont Schedule BA-402 is another document that shares similarities with the BI-472. This form is used to calculate apportionment percentages for businesses operating in multiple states. Both forms require careful calculations to determine how much income is attributable to Vermont. By using these forms together, businesses can ensure that they are accurately reporting their income and complying with state tax laws.

Form 4797, which is used to report the sale of business property, is also comparable to the Vermont BI-472. Both forms address capital gains and losses, allowing businesses to report their financial outcomes from property sales. The inclusion of capital gains in both forms highlights the importance of tracking these transactions for tax purposes, ensuring that businesses can accurately report their financial activities.

The federal Schedule E is similar as well, as it is used to report supplemental income and loss. This form captures income from rental real estate, partnerships, and S corporations, much like the BI-472. Both forms require detailed reporting of various income sources, making it easier for taxpayers to compile their financial information in one place for tax reporting.

In the realm of financial documentation, clarity and standardization are paramount, and various forms serve to streamline this process, such as the smarttemplates.net, which provides templates that can aid in organizing essential applicant information, thereby refining the job application process across different sectors.

Lastly, the Vermont Form BI-471 is closely related to the BI-472. While the BI-471 serves as the main business income tax return, the BI-472 provides additional details about specific income types. Both forms work together to ensure comprehensive reporting of a business's financial activities, helping to maintain transparency and compliance with state tax regulations.