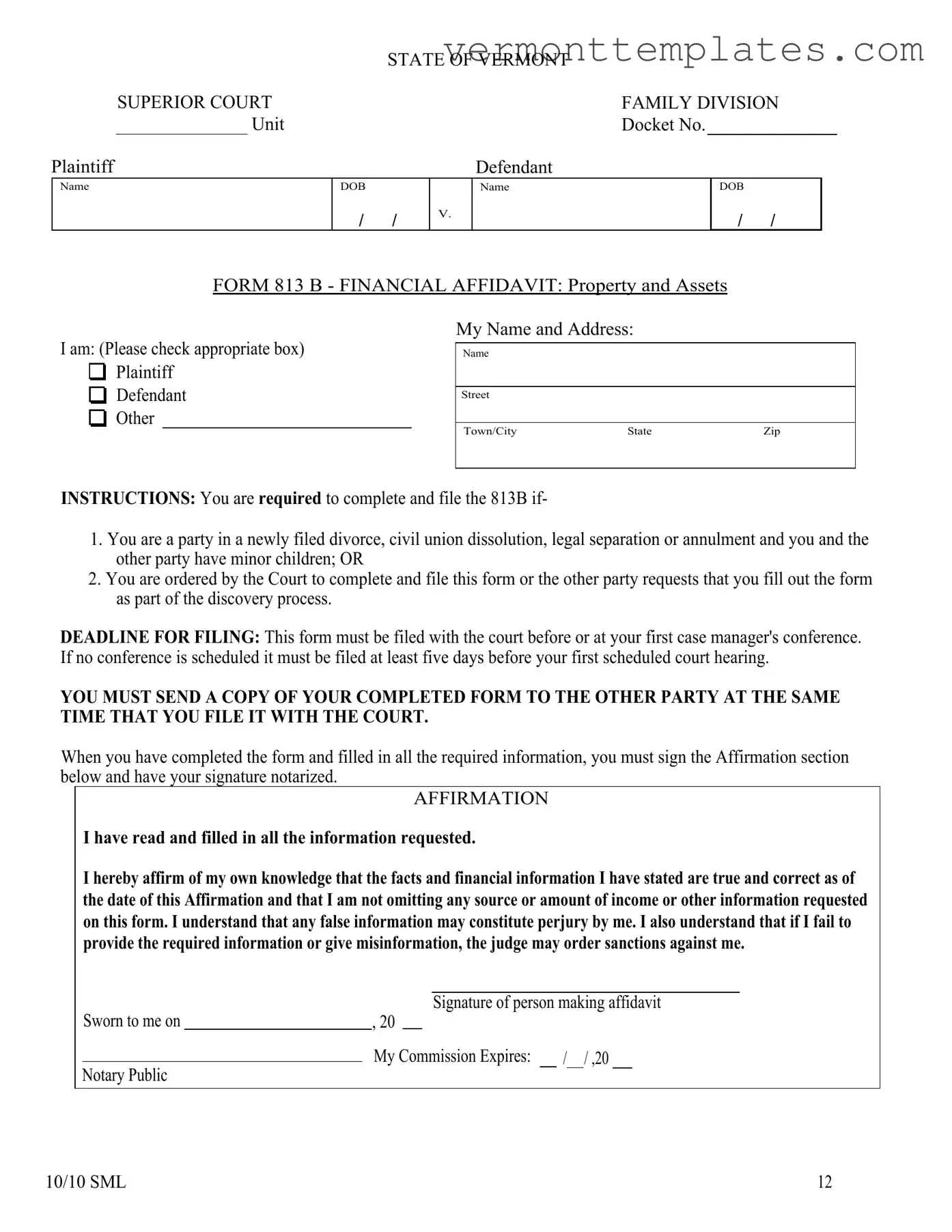

The Vermont 813B form is similar to the Financial Affidavit used in divorce proceedings in many states. This document requires parties to disclose their financial situations comprehensively. Like the 813B, it serves to ensure transparency between spouses regarding income, assets, and liabilities. Courts rely on this information to make informed decisions about alimony, child support, and property division. Both forms emphasize accuracy and honesty, with potential penalties for false statements.

Another comparable document is the Child Support Guidelines Worksheet, commonly utilized in family law cases. This worksheet outlines the income of both parents and calculates the support obligations based on state guidelines. Similar to the 813B, it aims to provide a clear financial picture to the court. Both documents require detailed financial disclosures, ensuring that all parties are aware of the financial circumstances that may affect child support decisions.

The Financial Disclosure Statement, often required in bankruptcy cases, shares similarities with the Vermont 813B form. This statement mandates that individuals disclose all assets, liabilities, income, and expenses. Like the 813B, it seeks to provide a full financial overview to facilitate fair outcomes in legal proceedings. Both forms require individuals to affirm the truthfulness of their disclosures, underscoring the importance of accuracy in legal matters.

The Affidavit of Financial Support is another document that resembles the Vermont 813B. Typically used in immigration cases, this affidavit requires sponsors to disclose their financial status to demonstrate their ability to support an immigrant. Both documents focus on presenting a clear financial picture to the relevant authorities, ensuring that all necessary information is available for decision-making purposes.

For a comprehensive understanding of the endorsement process, refer to the important Recommendation Letter guidelines, which provide valuable insights into crafting effective recommendation letters for various applications.

The Statement of Net Worth is frequently employed in divorce proceedings and shares key features with the Vermont 813B form. This statement provides a snapshot of an individual's financial standing, including assets and liabilities. Like the 813B, it is crucial for determining equitable distribution of property and financial responsibilities. Both documents require detailed financial reporting, making them essential tools in family law cases.

The Asset and Liability Statement is another document that bears resemblance to the Vermont 813B. This statement requires individuals to list all their assets and liabilities, providing a comprehensive overview of their financial health. Similar to the 813B, it serves to inform the court about an individual's financial situation, which is critical in legal proceedings involving financial disputes or divorce settlements.

The Disclosure of Financial Information form is used in various legal contexts, including family law and civil litigation. This form requires parties to provide detailed financial information, much like the Vermont 813B. Both documents aim to create transparency and allow the court to make informed decisions based on the financial realities of each party involved.

The Income and Expense Declaration is commonly used in family law cases and has similarities with the Vermont 813B. This declaration requires parties to provide detailed information about their income and expenses, helping the court assess financial obligations. Both forms emphasize the importance of complete and accurate financial disclosures to ensure fair outcomes in legal proceedings.

Lastly, the Financial Affidavit used in child custody cases mirrors the Vermont 813B in its purpose and structure. This affidavit requires parents to disclose their financial circumstances to help the court make informed decisions regarding custody and support. Both documents prioritize transparency and accuracy, aiming to protect the best interests of children involved in custody disputes.

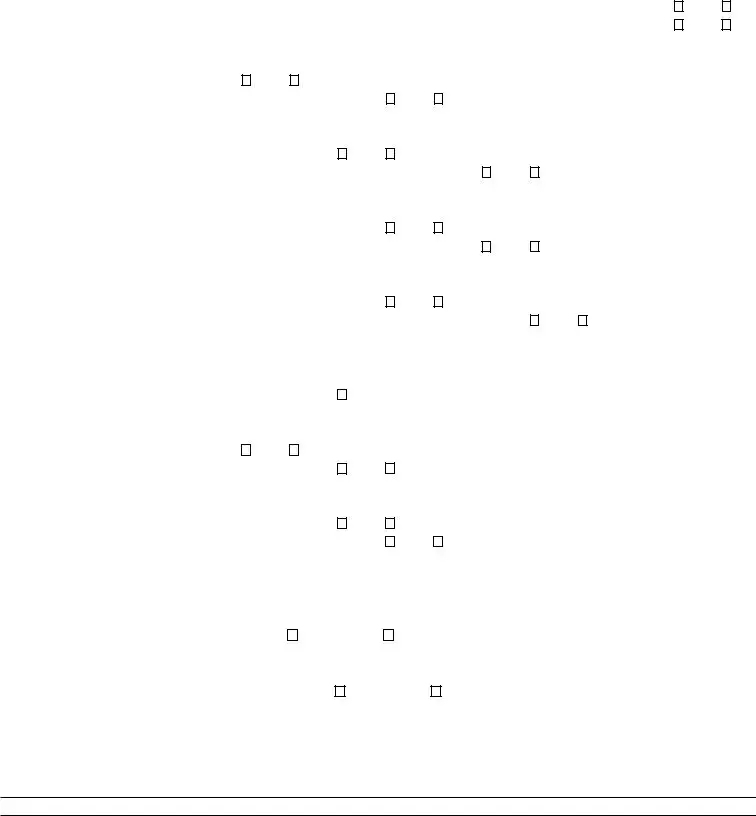

Plaintiff

Plaintiff

Defendant

Defendant

Other

Other

Yes

Yes  No

No

No

No