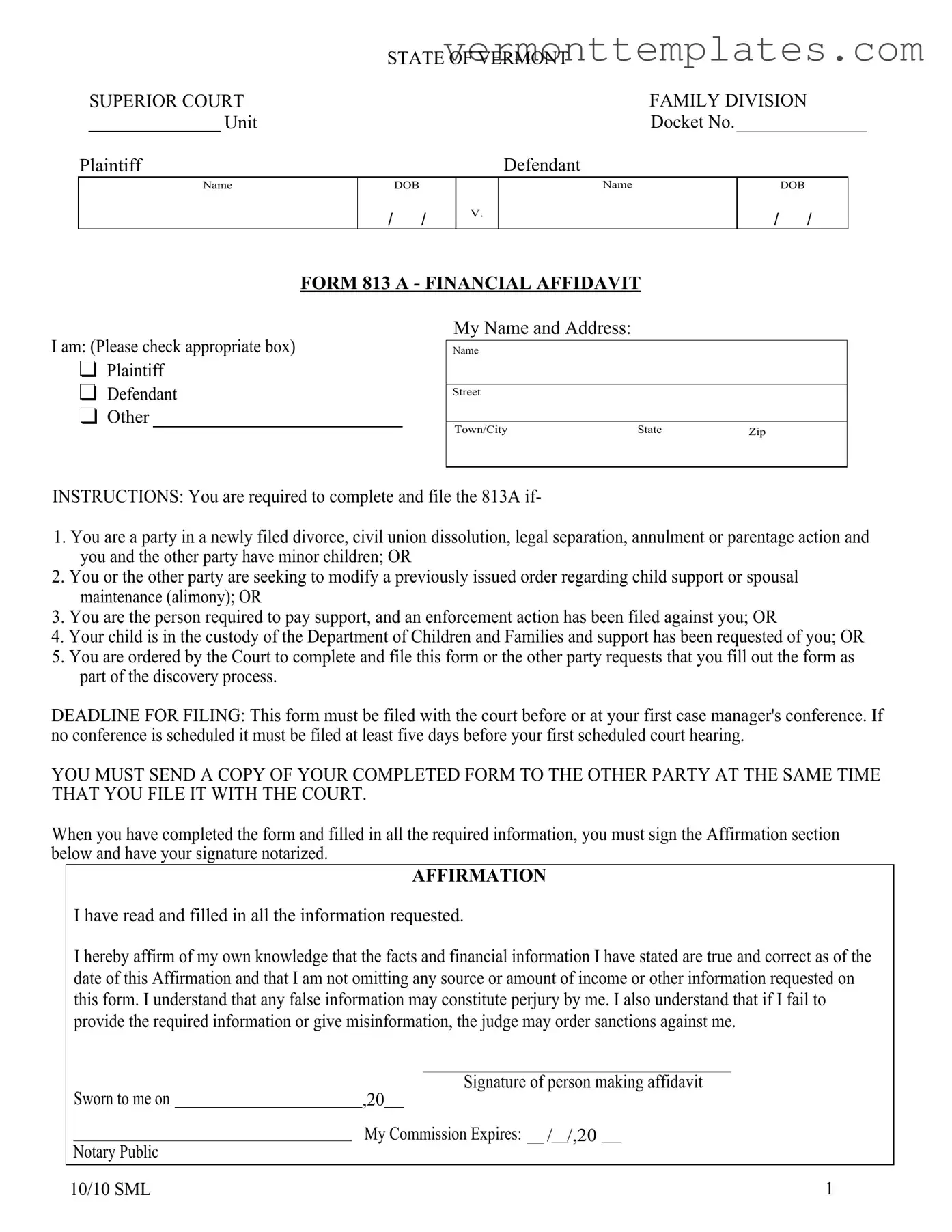

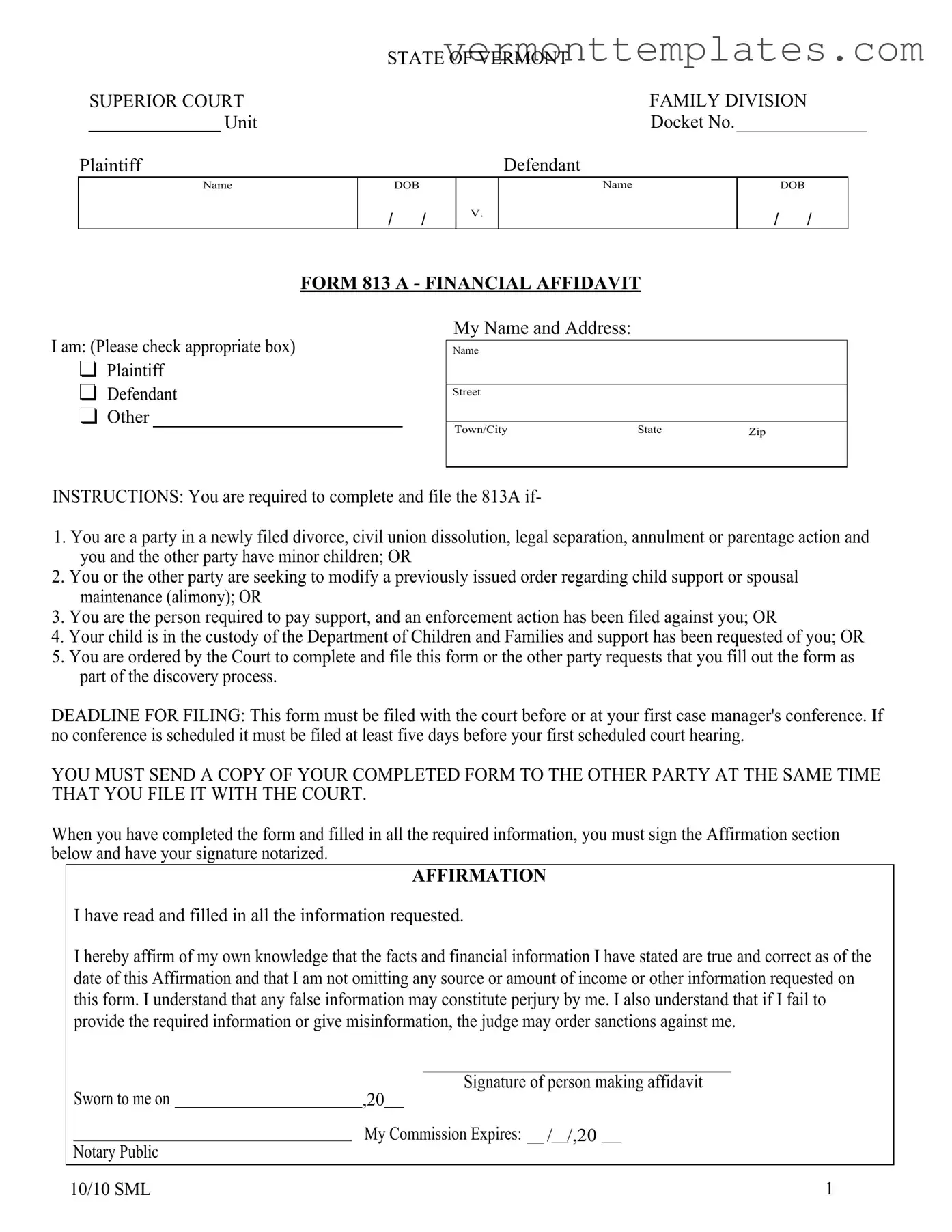

The Vermont 813 form is similar to the Financial Disclosure Form used in many family law cases across the United States. Like the Vermont 813, this document requires parties to disclose their financial situation, including income, expenses, and debts. Both forms serve the purpose of providing the court with necessary financial information to make informed decisions regarding child support, alimony, and other financial matters in family law cases. The emphasis on transparency and honesty in both forms is critical, as inaccuracies can lead to legal repercussions.

Another document that shares similarities with the Vermont 813 form is the Child Support Worksheet. This worksheet is often used in child support cases to calculate the amount of support one parent must pay to the other. Like the Vermont 813, it requires detailed financial information, including income and expenses. Both documents aim to ensure that the financial needs of the children are met and that both parents contribute fairly to their upbringing.

The Affidavit of Support is also akin to the Vermont 813 form, particularly in cases involving immigration. This document requires a sponsor to demonstrate their financial ability to support an immigrant. Similar to the Vermont 813, it includes sections for income, assets, and liabilities. Both forms necessitate accurate reporting of financial information to avoid potential legal issues, such as claims of fraud or misrepresentation.

The Financial Affidavit in divorce proceedings is another comparable document. This affidavit requires both parties to disclose their financial circumstances, including income, expenses, and debts. Like the Vermont 813, it plays a crucial role in determining equitable distribution of assets and liabilities during a divorce. The requirement for notarization and affirmation of truthfulness is also a common element in both documents, emphasizing the importance of honesty in legal proceedings.

The Statement of Net Worth is similar to the Vermont 813 form as well. This document is often used in divorce cases to summarize a party's financial status. It includes information about income, expenses, assets, and liabilities, just like the Vermont 813. Both documents serve to provide a clear picture of an individual’s financial situation, which is essential for the court's decision-making process.

The Income and Expense Declaration is another document that resembles the Vermont 813 form. This declaration is often required in family law cases to provide a comprehensive overview of a party's financial situation. Similar to the Vermont 813, it includes sections for detailing income sources and monthly expenses. Both forms aim to facilitate fair outcomes in child support and alimony determinations by ensuring that the court has access to accurate financial information.

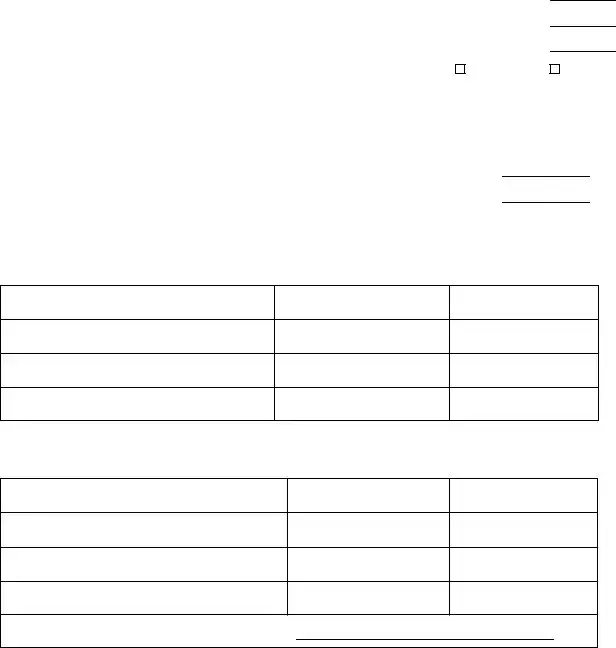

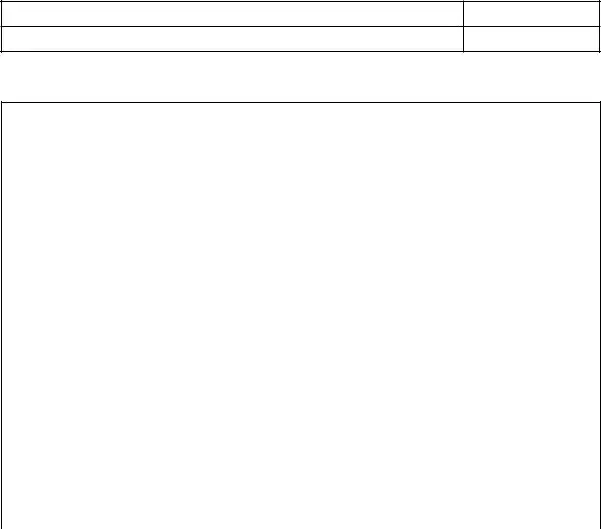

The Chick Fil A Job Application form is a crucial document for individuals seeking employment at any of the restaurant's locations. It serves as the first step in the employment process, allowing candidates to present their qualifications and interest in joining the team. The content of this form is designed to capture essential personal, educational, and professional information from applicants, making it important for job seekers to fill it out accurately and thoroughly. For those interested in applying, more resources and templates can be found at toptemplates.info, which can assist in the application process.

The Child Support Financial Statement is also comparable to the Vermont 813 form. This statement is used to outline a parent's financial situation when determining child support obligations. Like the Vermont 813, it requires detailed information about income, expenses, and other financial responsibilities. Both documents are designed to ensure that child support calculations are based on complete and accurate financial data.

The Spousal Support Worksheet shares similarities with the Vermont 813 form as well. This worksheet is utilized to assess the financial circumstances of both parties in spousal support cases. It requires comprehensive financial disclosures, much like the Vermont 813. Both documents aim to promote fairness in determining support obligations, taking into account each party's financial capabilities and needs.

The Financial Statement for Support is another document that aligns closely with the Vermont 813 form. This statement is often required in family law cases to provide the court with a detailed account of a party's financial situation. Similar to the Vermont 813, it includes information about income, expenses, and financial obligations. Both forms are crucial for ensuring that the court has a clear understanding of each party's financial status when making support decisions.

Lastly, the Disclosure of Assets and Liabilities form is comparable to the Vermont 813 form. This document is used in various legal proceedings to provide a comprehensive overview of an individual's financial situation. Like the Vermont 813, it requires detailed disclosures regarding income, assets, and debts. Both forms serve to promote transparency and fairness in legal matters, ensuring that all parties involved have a clear understanding of the financial landscape.

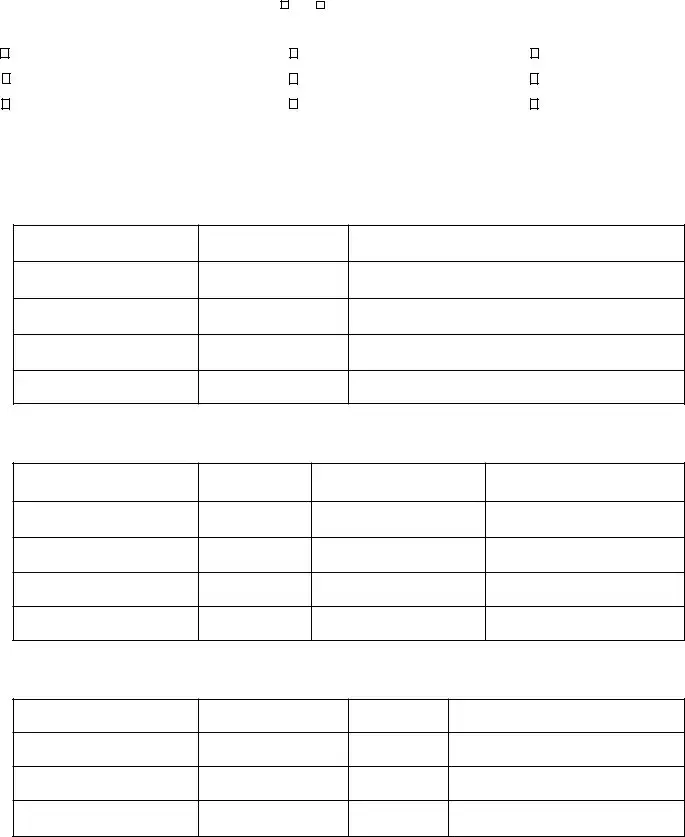

Plaintiff

Plaintiff

Defendant

Defendant

Other

Other

Yes

Yes