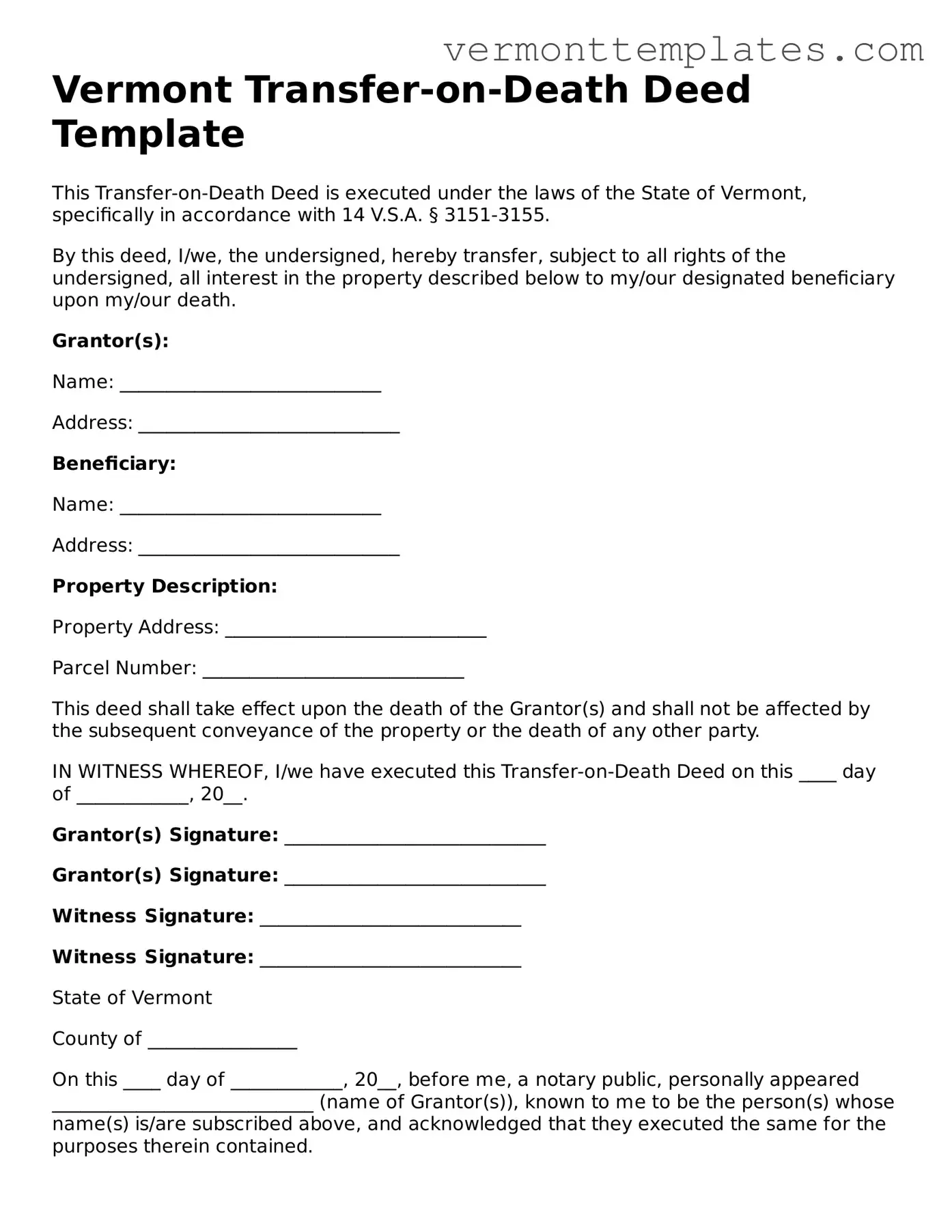

Legal Transfer-on-Death Deed Template for Vermont

The Vermont Transfer-on-Death Deed form is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This form provides a straightforward way to ensure that your property goes directly to your loved ones without unnecessary delays or costs. Understanding its provisions and requirements is essential for effective estate planning.

Open Transfer-on-Death Deed Editor

Legal Transfer-on-Death Deed Template for Vermont

Open Transfer-on-Death Deed Editor

Complete the form at top speed

Edit, save, and download Transfer-on-Death Deed online with ease.

Open Transfer-on-Death Deed Editor

or

⇩ Transfer-on-Death Deed PDF Form