The S-3M Vermont form shares similarities with the IRS Form 4506-T, which is used to request a transcript of tax returns. Both documents require the identification of the requester and the purpose of the request. While the S-3M focuses on tax exemption for specific purchases in manufacturing and related fields, Form 4506-T is aimed at obtaining tax information for various purposes, such as loan applications or audits. Each form emphasizes the importance of accurate information and requires a signature to validate the request.

Another comparable document is the IRS Form W-9, which is used to provide taxpayer identification information. Similar to the S-3M, the W-9 requires the name, address, and taxpayer identification number of the individual or business. Both forms serve as essential tools for ensuring compliance with tax regulations. While the S-3M is specifically for claiming exemptions in Vermont, the W-9 is often used in various transactions to confirm the status of the taxpayer.

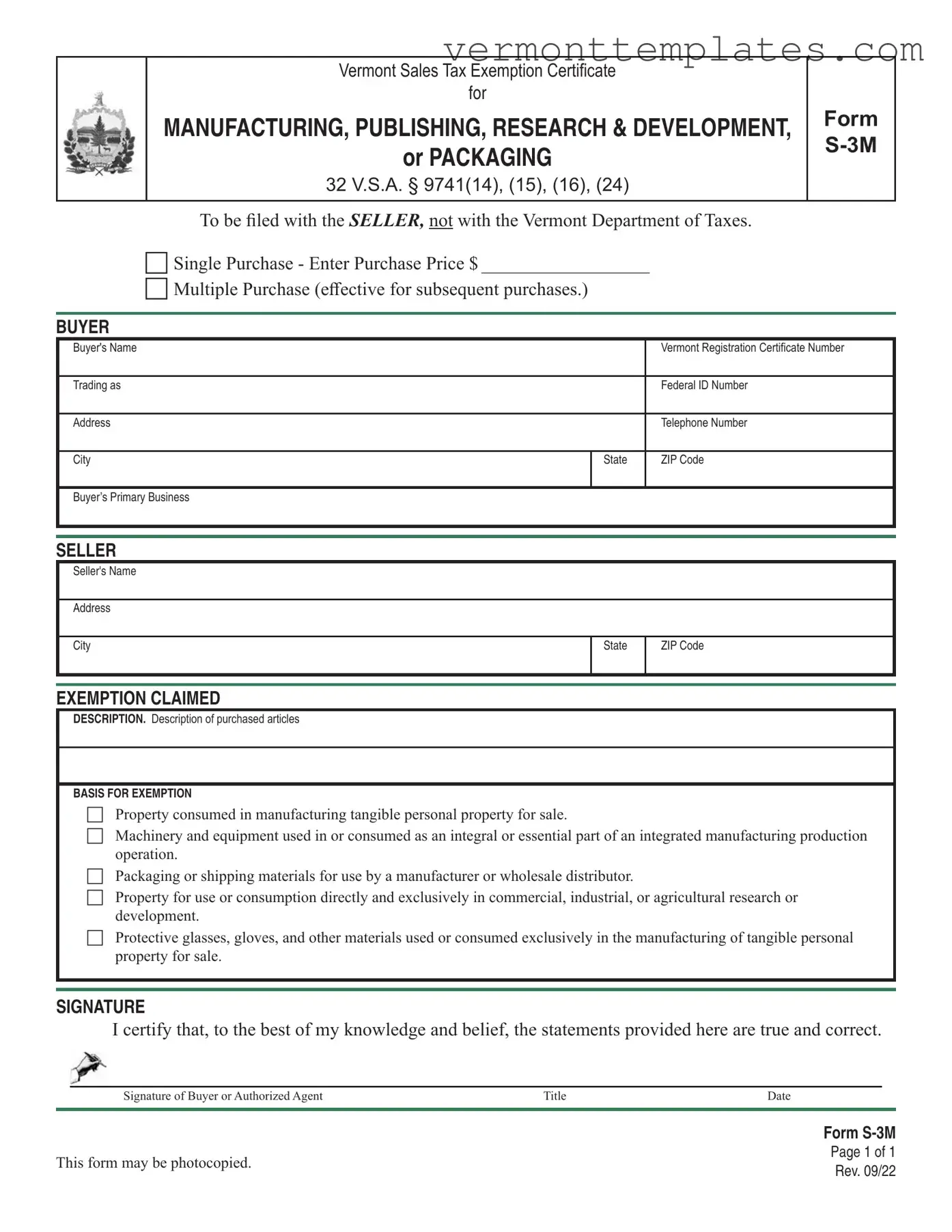

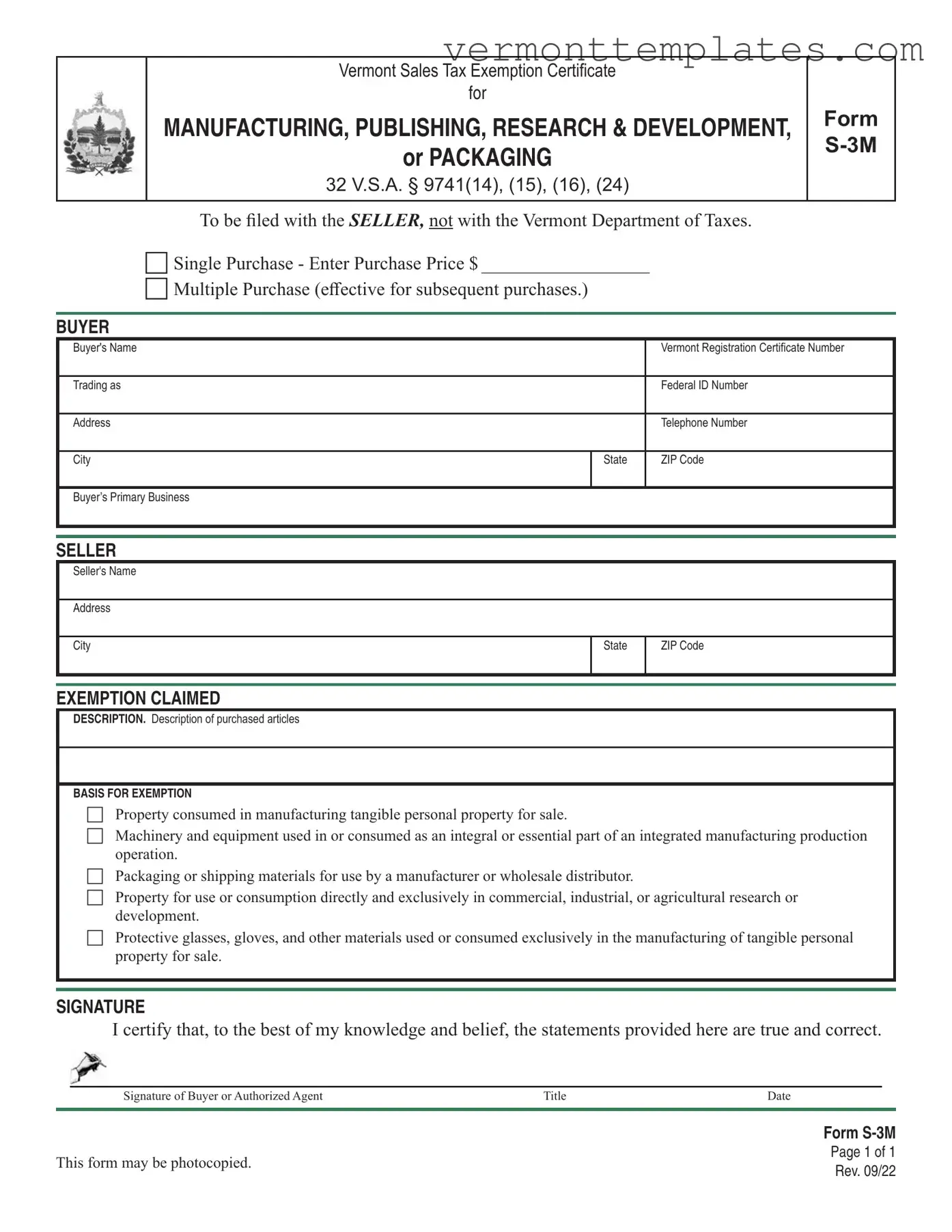

The Sales Tax Exemption Certificate, commonly used in many states, is also akin to the S-3M form. This certificate allows buyers to purchase goods without paying sales tax if the items are intended for resale or specific uses. Like the S-3M, the Sales Tax Exemption Certificate requires details about the buyer and the nature of the exemption being claimed. Both documents are essential in maintaining proper tax compliance and ensuring that sellers are protected from tax liabilities.

For those managing real estate and seeking a simplified process of transferring property, it's important to consider options such as the Transfer-on-Death Deed, which can be filled out by visiting https://arizonapdf.com/transfer-on-death-deed, ensuring that beneficiaries receive the intended assets without the complications of probate court or traditional wills.

Form ST-5, used in Massachusetts, is another document similar to the S-3M. This form serves as a sales tax exemption certificate for purchases made by exempt organizations. Both forms require the buyer's information and the specific exemption being claimed. They both aim to facilitate tax-exempt purchases while providing a legal safeguard for sellers against tax collection responsibilities.

In New York, the ST-121 Exempt Use Certificate is comparable to the S-3M. This form allows businesses to claim exemption from sales tax on purchases made for resale or specific exempt purposes. The structure of both forms is similar, requiring the buyer's details and the nature of the exemption. Both are crucial in ensuring that tax laws are followed while allowing businesses to operate without the burden of unnecessary tax costs.

The Certificate of Exemption for Nonprofit Organizations, often used in various states, parallels the S-3M in that it allows qualifying organizations to make tax-exempt purchases. Both documents necessitate the identification of the organization and the reason for the exemption. They serve as vital tools for nonprofits, ensuring that they can allocate resources effectively without incurring additional tax expenses.

The Resale Certificate is another document that resembles the S-3M. This certificate allows businesses to purchase goods intended for resale without paying sales tax. Both forms require the buyer's information and a declaration of the intended use of the purchased items. They are critical for maintaining compliance with tax laws while enabling businesses to operate efficiently.

Lastly, the IRS Form 8832, which is used to elect how an entity is classified for federal tax purposes, shares some common ground with the S-3M. Both forms require specific information about the entity involved and must be signed to be valid. While the S-3M is focused on state-level sales tax exemptions, Form 8832 addresses federal tax classifications, highlighting the importance of accurate documentation in tax-related matters.