The IRS Form 501(c)(3) application is similar to the S 3C Vermont form in that both are used to establish and confirm the tax-exempt status of organizations. The IRS Form 501(c)(3) is specifically for nonprofit organizations seeking federal tax exemption. Like the S 3C form, it requires detailed information about the organization, including its purpose and activities. Both forms aim to ensure that the entity qualifies for tax benefits based on their charitable, educational, or public service missions.

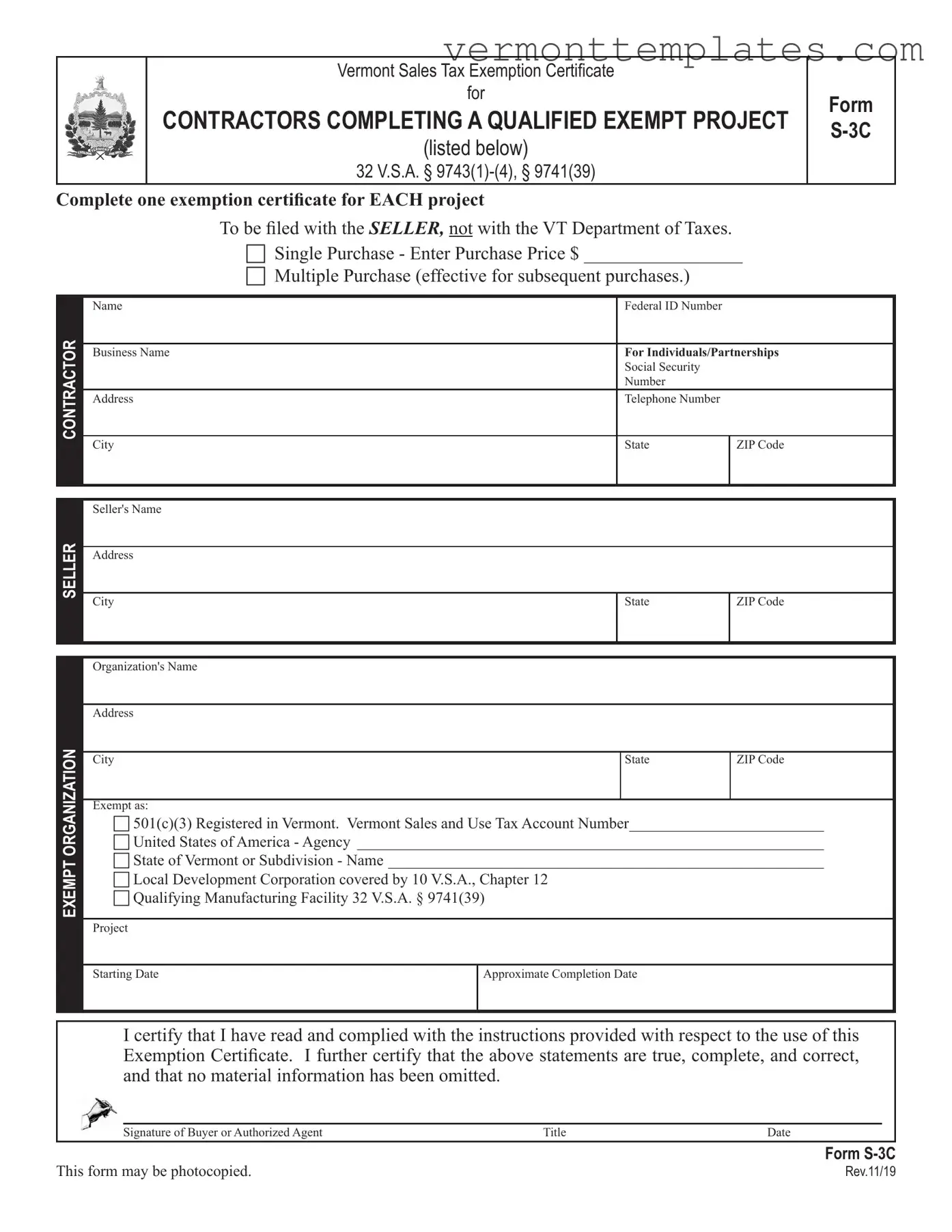

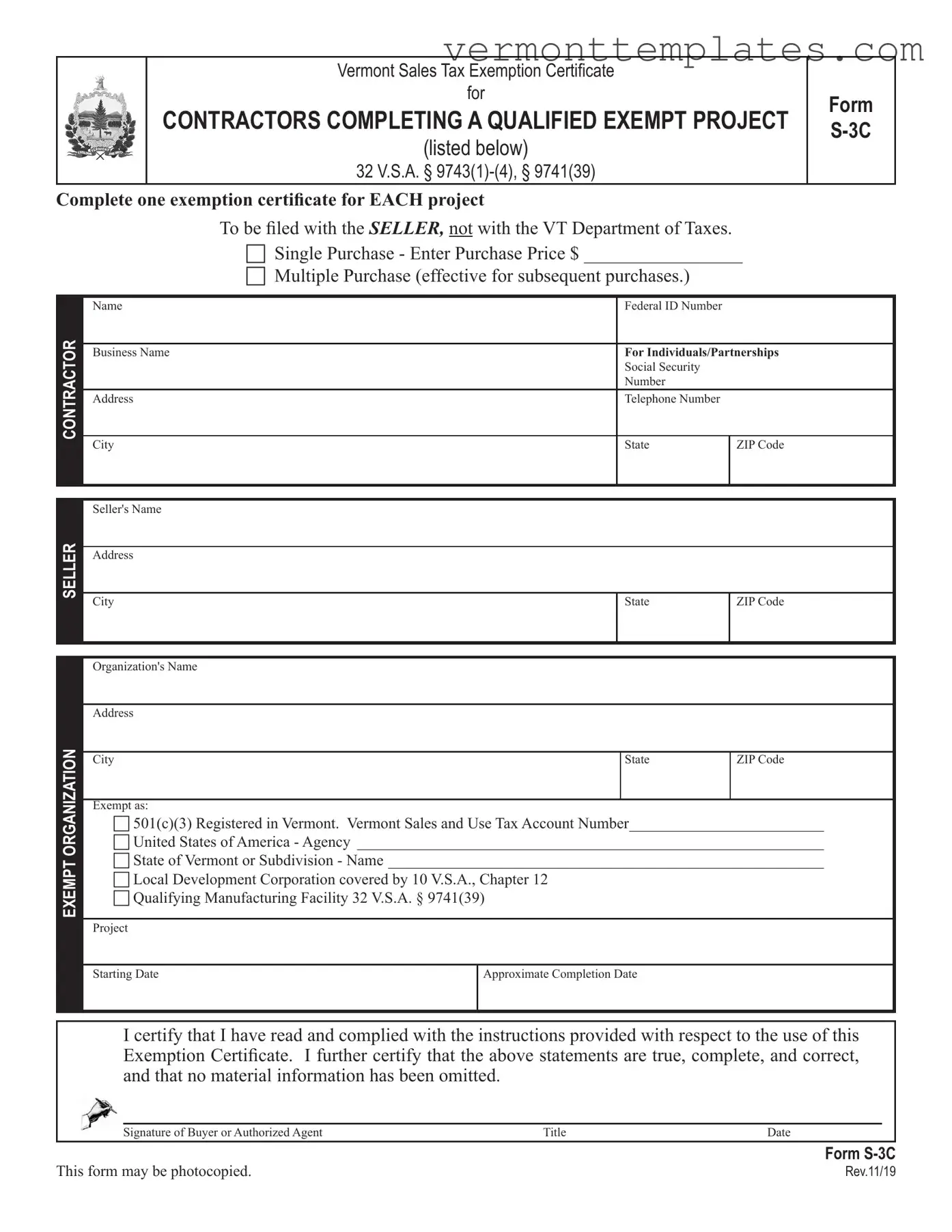

The Sales Tax Exemption Certificate (STEC) is another document that parallels the S 3C form. The STEC allows buyers to purchase goods without paying sales tax if they meet certain criteria. Similar to the S 3C, it requires the buyer to provide information about the exempt purpose of their purchase. Both forms serve to document the tax-exempt status of purchases and ensure compliance with tax regulations.

The Contractor Exemption Certificate (CEC) is also akin to the S 3C form, as it is specifically designed for contractors working on projects for exempt organizations. The CEC allows contractors to purchase materials without incurring sales tax, provided the materials are used in qualifying projects. Like the S 3C form, the CEC requires the contractor to certify the nature of the project and the exempt status of the organization involved.

The Form ST-5, used in Massachusetts, is comparable to the S 3C Vermont form. This form allows for sales tax exemption on certain purchases made by exempt organizations. Both forms require similar information, including the purchaser's details and the specific exempt purpose for the transaction. The intent behind both forms is to streamline the process for exempt organizations to acquire necessary goods without the burden of sales tax.

The New York State Exempt Organization Certificate (Form ST-119.1) shares similarities with the S 3C form as well. This certificate allows exempt organizations to purchase goods and services without paying sales tax. Both forms require the organization to provide proof of their exempt status and details regarding the nature of the purchases. The primary goal is to facilitate tax-free transactions for qualifying entities.

The Illinois Sales Tax Exemption Certificate is another document that functions similarly to the S 3C form. This certificate allows eligible organizations to make tax-exempt purchases. Like the S 3C, it requires the organization to declare its exempt status and the purpose of the purchase. Both forms help ensure that the tax-exempt entities can operate without the financial burden of sales tax on necessary purchases.

When preparing to apply for various tax exemptions, organizations may find it beneficial to utilize an Employment Application PDF form, as it can help in providing structured and standardized information essential for establishing eligibility. Such documents, including those available at smarttemplates.net, play a crucial role in outlining the necessary details about an organization's operations, ensuring that all required information is consolidated effectively to facilitate the application process.

The Form ST-2 in New Jersey is comparable to the S 3C form as well. This form allows for the exemption of sales tax for certain organizations and purchases. Both forms require the buyer to assert their tax-exempt status and detail the nature of the goods or services being purchased. They serve to ensure compliance with state tax laws while facilitating necessary transactions for exempt organizations.

Finally, the Pennsylvania Exempt Use Certificate is similar to the S 3C form in its purpose of allowing tax-exempt purchases. This certificate requires the buyer to provide information about their exempt status and the intended use of the purchased items. Both forms are designed to simplify the purchasing process for organizations that qualify for tax exemptions, ensuring compliance with state tax regulations.