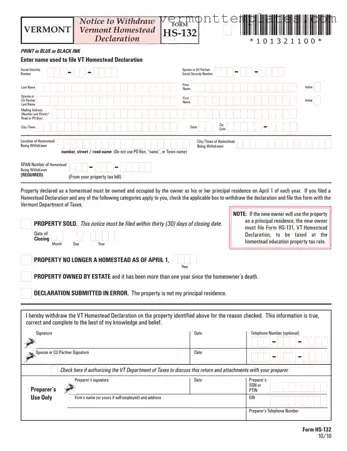

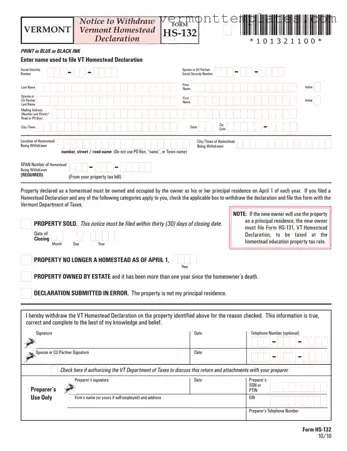

The Vermont HS-132 form is a notice used to withdraw a Homestead Declaration in Vermont. Homeowners must complete this form when their property is no longer classified as a homestead due to reasons such as selling the property, it no...

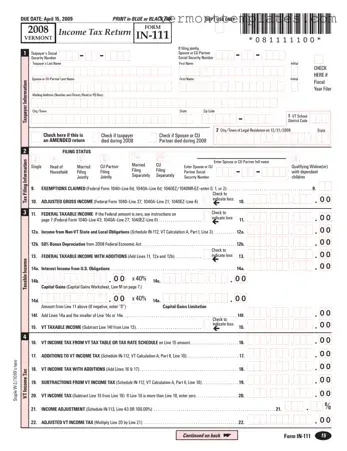

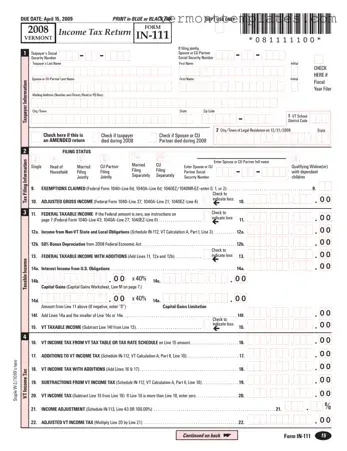

The Vermont IN-111 form is a document used by residents of Vermont to file their state income tax returns. This form collects essential information regarding income, deductions, and tax liabilities for the fiscal year. Proper completion of the IN-111 is...

The Vermont In 152 form is a worksheet used by taxpayers to calculate underpayment of estimated income tax for the state of Vermont. This form helps individuals determine if they owe any penalties or interest due to insufficient tax payments...

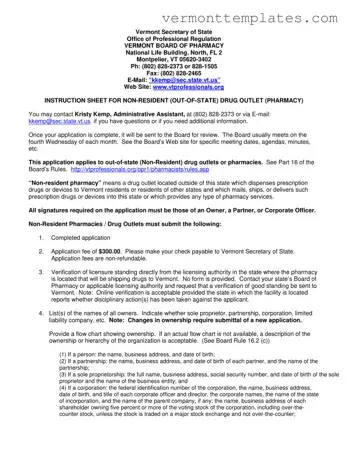

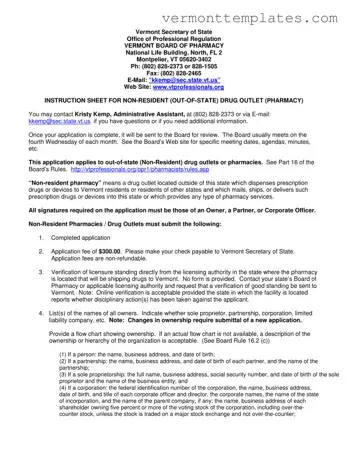

The Vermont Non Resident Pharmacy form is an application required for out-of-state pharmacies that wish to dispense prescription drugs to Vermont residents. This form ensures that these pharmacies comply with Vermont's regulations and standards for pharmacy practice. It is essential...

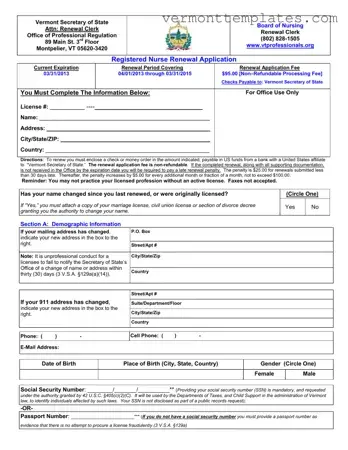

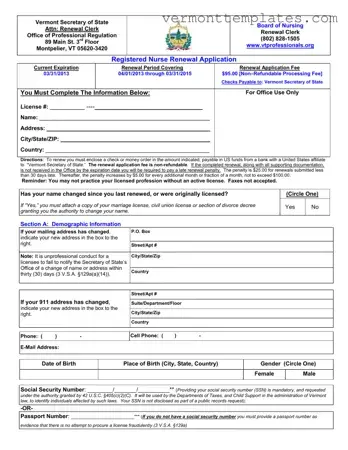

The Vermont Nurse Renewal form is a crucial document for registered nurses seeking to maintain their professional licensure in Vermont. This form must be submitted to the Vermont Secretary of State’s Office of Professional Regulation prior to the expiration of...

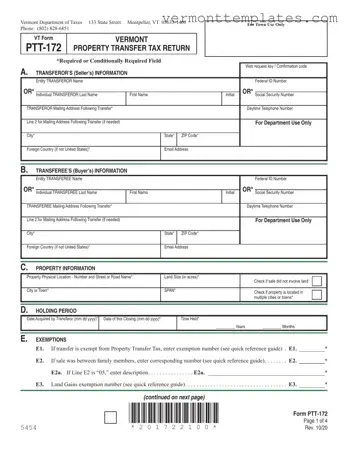

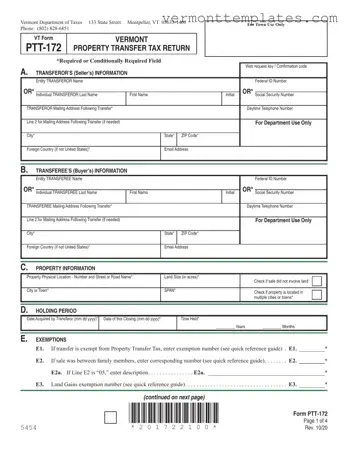

The Vermont Pt 172 S form, also known as the Property Transfer Tax Return, is a document required when real estate is transferred in Vermont. This form collects essential information about the transferor (seller) and transferee (buyer), as well as...

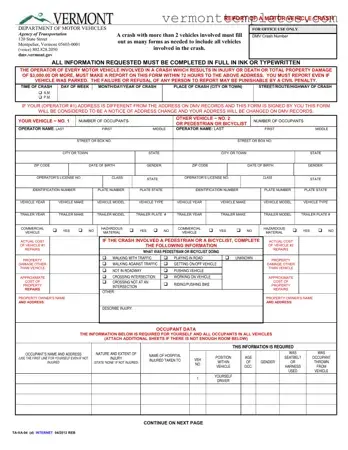

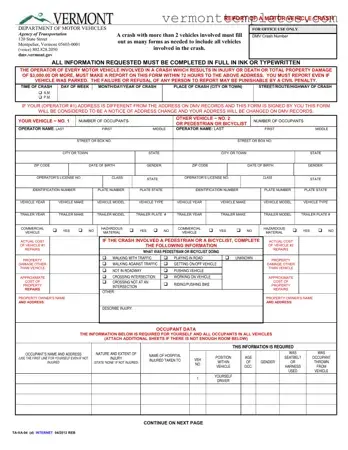

The Vermont Report form is a document required by the Vermont Department of Motor Vehicles for reporting motor vehicle crashes. This form must be completed by the operators of all vehicles involved in an accident that results in injury, death,...

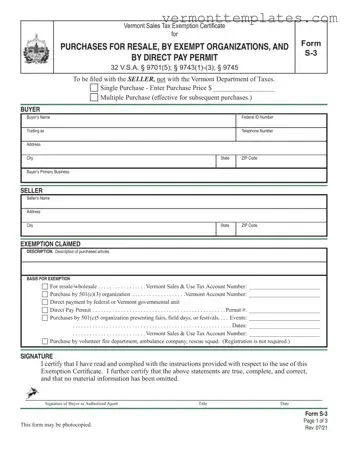

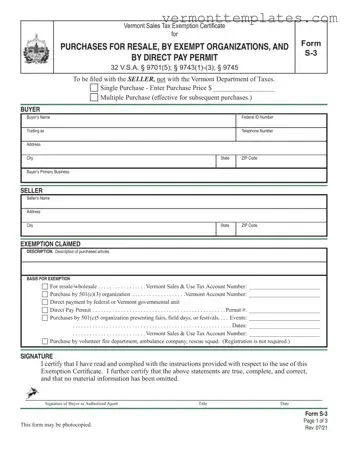

The Vermont S-3 form is a Sales Tax Exemption Certificate designed for buyers making purchases for resale or by specific exempt organizations. This form must be provided to the seller, not filed with the Vermont Department of Taxes. Understanding how...